LATEST_NEWS

Bahria Town karachi 2026 - Tax Guide for Buyer and Sellers

Bahria Town Karachi 2026 – Tax Guide for Buyers and Sellers

Bahria Town Karachi has one of the simplest and most transparent property transfer systems in Pakistan. Unlike many other areas of Karachi, Bahria Town Karachi offers a corruption-free, verified, and secure transfer process with no duplication, no verification issues, and no illegal payments.

If you have finalized your plot, villa, apartment, or commercial property, it is very important to understand the FBR property taxes applicable in 2026 before proceeding with the transfer.

In this blog, we will ONLY discuss FBR Advance Income Tax 2026

Why Bahria Town Karachi Transfer Process Is Better

-

Simple and fast transfer system

-

No corruption or illegal payments

-

No duplication issues

-

No third-party verification problems

-

Transparent tax calculation based on FBR valuation

This makes Bahria Town Karachi one of the safest real estate markets in Pakistan.

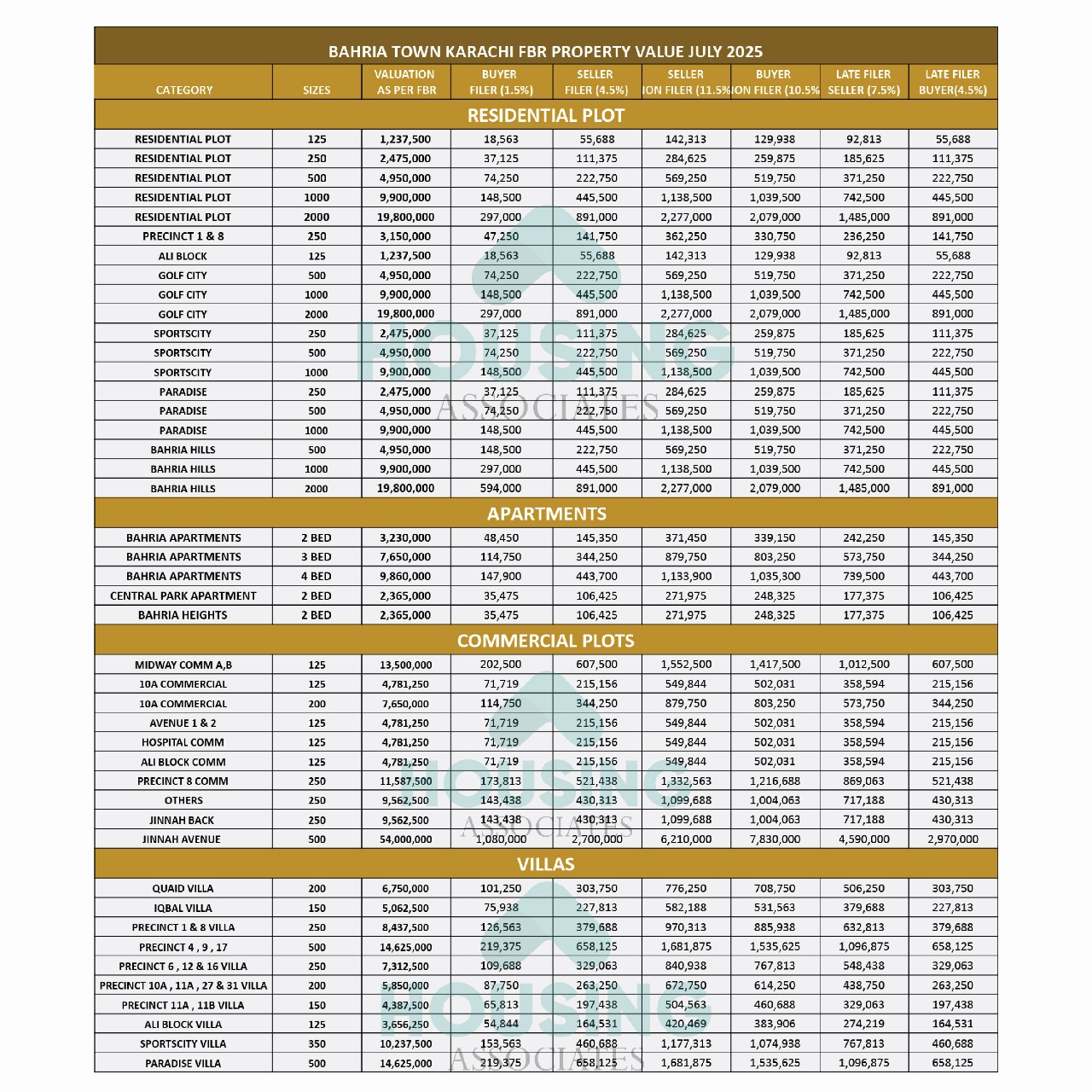

FBR Advance Income Tax 2026 (July 2025 – June 2026)

For the fiscal year July 2025 to June 2026, FBR taxes on Bahria Town Karachi properties will be collected strictly according to the valuation table below.

Taxes depend on the status of buyer and seller:

-

Filer

-

Non-Filer

-

Late Filer

FBR Property Valuation & Tax – Bahria Town Karachi (2026)

Residential Plots – FBR Tax Table

| Size (Sq Yd) | FBR Valuation (PKR) | Buyer Filer 1.5% | Seller Filer 4.5% | Seller Non-Filer 11.5% | Buyer Non-Filer 10.5% | Seller Late Filer 7.5% | Buyer Late Filer 4.5% |

|---|---|---|---|---|---|---|---|

| 125 | 1,237,500 | 18,563 | 55,688 | 142,313 | 129,938 | 92,813 | 55,688 |

| 250 | 2,475,000 | 37,125 | 111,375 | 284,625 | 259,875 | 185,625 | 111,375 |

| 500 | 4,950,000 | 74,250 | 222,750 | 569,250 | 519,750 | 371,250 | 222,750 |

| 1,000 | 9,900,000 | 148,500 | 445,500 | 1,138,500 | 1,039,500 | 742,500 | 445,500 |

| 2,000 | 19,800,000 | 297,000 | 891,000 | 2,277,000 | 2,079,000 | 1,485,000 | 891,000 |

Apartments – FBR Tax Table

| Apartment Type | FBR Valuation (PKR) | Buyer Filer | Seller Filer | Seller Non-Filer | Buyer Non-Filer | Seller Late Filer | Buyer Late Filer |

|---|---|---|---|---|---|---|---|

| Bahria Apartment 2 Bed | 3,230,000 | 48,450 | 145,350 | 371,450 | 339,150 | 242,250 | 145,350 |

| Bahria Apartment 3 Bed | 7,650,000 | 114,750 | 344,250 | 879,750 | 803,250 | 573,750 | 344,250 |

| Bahria Apartment 4 Bed | 10,030,000 | 150,450 | 451,350 | 1,153,450 | 1,053,150 | 752,250 | 451,350 |

| Bahria Heights 2 Bed | 2,365,000 | 35,475 | 106,425 | 271,975 | 248,325 | 177,375 | 106,425 |

Commercial Plots – FBR Tax Table

| Location | Size | FBR Valuation | Buyer Filer | Seller Filer | Seller Non-Filer | Buyer Non-Filer |

|---|---|---|---|---|---|---|

| Midway Commercial A/B | 125 | 13,500,000 | 202,500 | 607,500 | 1,552,500 | 1,417,500 |

| 10A Commercial | 125 | 4,781,250 | 71,719 | 215,156 | 549,844 | 502,031 |

| Precinct 8 Commercial | 250 | 11,587,500 | 173,813 | 521,438 | 1,332,563 | 1,216,688 |

| Jinnah Avenue | 500 | 54,000,000 | 1,080,000 | 2,700,000 | 6,210,000 | 7,830,000 |

Villas – FBR Tax Table

| Villa Type | Size | FBR Valuation | Buyer Filer | Seller Filer | Seller Non-Filer | Buyer Non-Filer |

|---|---|---|---|---|---|---|

| Quaid Villa | 200 | 6,750,000 | 101,250 | 303,750 | 776,250 | 708,750 |

| Iqbal Villa | 150 | 5,062,500 | 75,938 | 227,813 | 582,188 | 531,563 |

| Sports City Villa | 350 | 10,237,500 | 153,563 | 460,688 | 1,177,313 | 1,074,938 |

| Paradise Villa | 500 | 14,625,000 | 219,375 | 658,125 | 1,681,875 | 1,535,625 |

Understanding Filer, Non-Filer & Late Filer (Important)

Filer

A filer is a person who:

-

Files income tax returns every year regularly

-

Gets the lowest tax rates

Non-Filer

A non-filer:

-

Does not file income tax returns

-

Pays very high tax rates

-

Faces heavy deductions at transfer

Late Filer (New Government Concept)

-

If a non-filer purchases property and then files a return, he does NOT become a filer immediately

-

He is considered a Late Filer

-

A late filer must file tax returns consistently for 2 years

-

Only after that period will he get full filer status

This rule applies in July 2025 – June 2026 transfers.

Why Understanding Tax Before Transfer Is Important

-

Helps buyers calculate true cost

-

Helps sellers know net amount after tax

-

Avoids surprises at transfer office

-

Encourages becoming a regular filer

Frequently Asked Questions (FAQs)

Q1: Is Bahria Town Karachi transfer process safe?

Yes. It is one of the most secure and transparent transfer systems in Pakistan.

Q2: Are these taxes applicable in 2026?

Yes. These FBR taxes apply from July 2025 to June 2026.

Q3: Does Bahria Town collect these taxes?

No. These are FBR Advance Income Taxes, collected during transfer.

Q4: Can a non-filer avoid high tax?

No. A non-filer must first become a late filer and file returns for 2 years.

Final Words

If you are searching for:

-

Bahria Town Karachi tax guide 2026

-

FBR tax on Bahria Town Karachi property

-

Bahria Town Karachi transfer tax

-

Buyer seller tax in Bahria Town Karachi

This guide gives you a complete, updated, and accurate picture of property taxes in Bahria Town Karachi for 2026.